The Dollar Game Explained

The U.S. has some clever tricks up its sleeve when it comes to global trade. Lately, you might have noticed the dollar losing value—but that’s not an accident. Here’s the story:

Back in the day, most countries tied their currencies to the U.S. dollar, which was linked to gold. The U.S. kept things stable by stockpiling gold to back the dollar. But other countries, especially in Europe, started bending the rules to help their own economies. So in the 1970s, President Nixon ditched the gold standard altogether. Imagine if the U.S. still had to buy gold today at sky-high prices—it would’ve been a mess!

Once the gold standard was gone, the dollar became the world’s go-to currency. Other countries’ money started bouncing up and down in value, while the dollar ruled global trade.

After 2010, the dollar got stronger and stronger. This was great for Americans because imported goods got cheaper, and people felt richer.

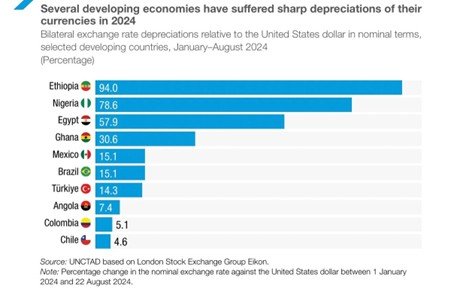

In the process a lot of currencies around the world weakened and a lot of countries were forced to spend their reserves to defend their currencies.

But there was a downside: U.S. products became too expensive for other countries to buy, hurting American businesses.

Now, the U.S. is flipping the script. They’re letting the dollar weaken on purpose to make American exports more affordable again. Currencies that lost value during the dollar’s rise (like the euro or yen) are likely to rebound. Countries that didn’t use this time to build strong export economies might struggle now.

China played this game smartly. Instead of hoarding gold, they stockpiled U.S. dollars and other major currencies. This lets them ride the waves of currency changes and boost their trade power.

Bottom line: If your country didn’t take advantage of the last 20 years—when a strong dollar made your exports cheaper—you might be in trouble now. The U.S. is gearing up to sell cheaper goods worldwide and reclaim its competitive edge. Game on!