Executive Summary

Ghana’s capital markets are experiencing a profound structural transformation characterized by unprecedented liquidity conditions, dramatic interest rate compression, and anticipation of aggressive monetary policy easing. This shift represents the most significant pro-growth monetary pivot since 2020, with far-reaching implications for financial institutions, consumers, and the broader economy.

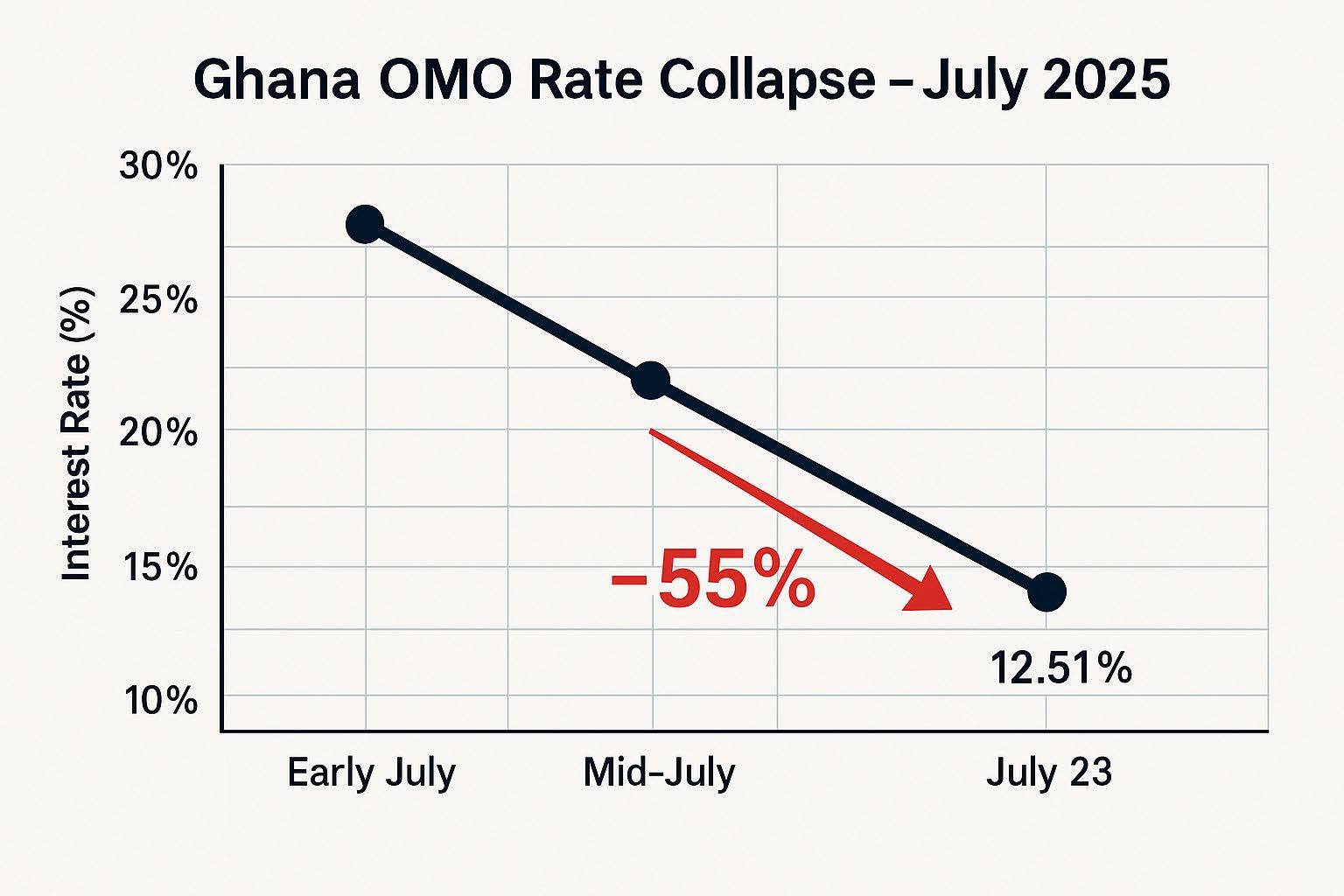

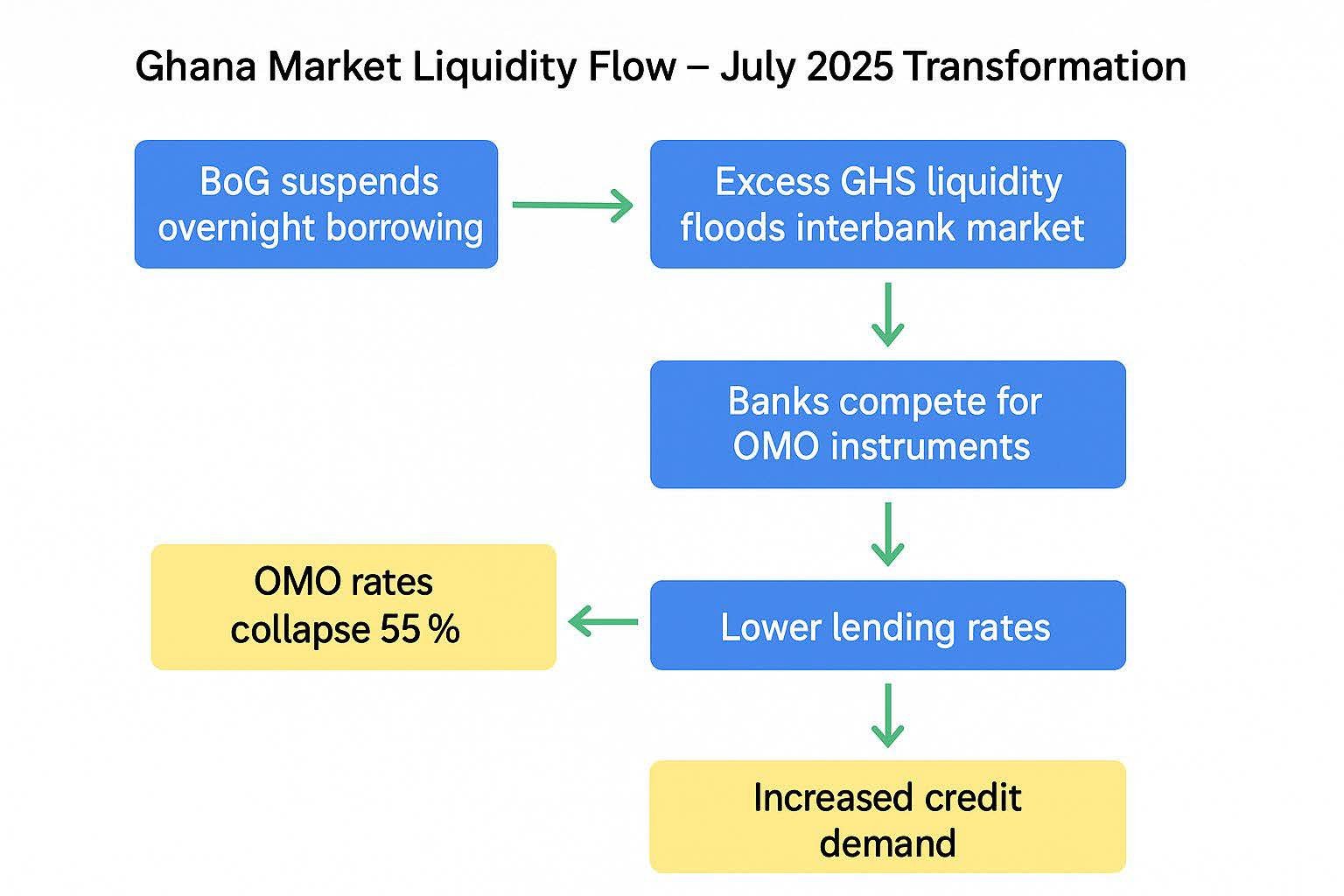

The Bank of Ghana’s (BoG) operational adjustments, including the suspension of overnight borrowing facilities and significant reduction in Open Market Operations (OMO) issuance, have flooded the interbank market with excess Ghana cedi (GHS) liquidity. This liquidity surge has triggered a cascading effect across the interest rate spectrum, with OMO rates experiencing a dramatic 55% decline from 28% to 12.51% within a two-week period. The velocity and magnitude of this rate compression signal a fundamental reset in Ghana’s monetary landscape.

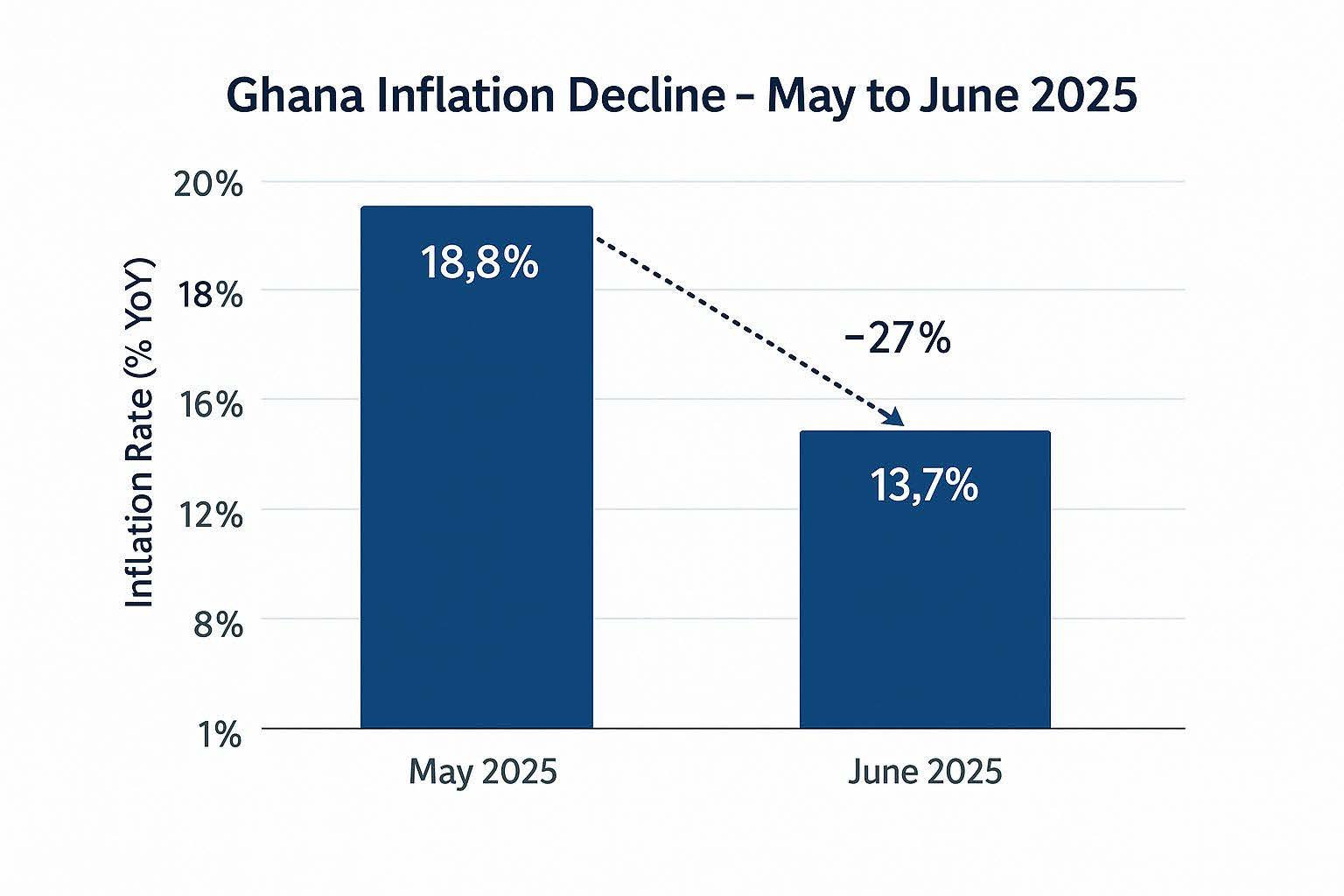

Concurrent with these liquidity dynamics, Ghana’s inflation trajectory has shown marked improvement, declining from 18.8% in May to 13.7% in June 2025. This disinflation trend, combined with abundant domestic currency liquidity, has created the conditions for interest rates to normalize to pre-COVID levels, with Treasury bills now yielding approximately 13.7% and government bonds around 16.5%.

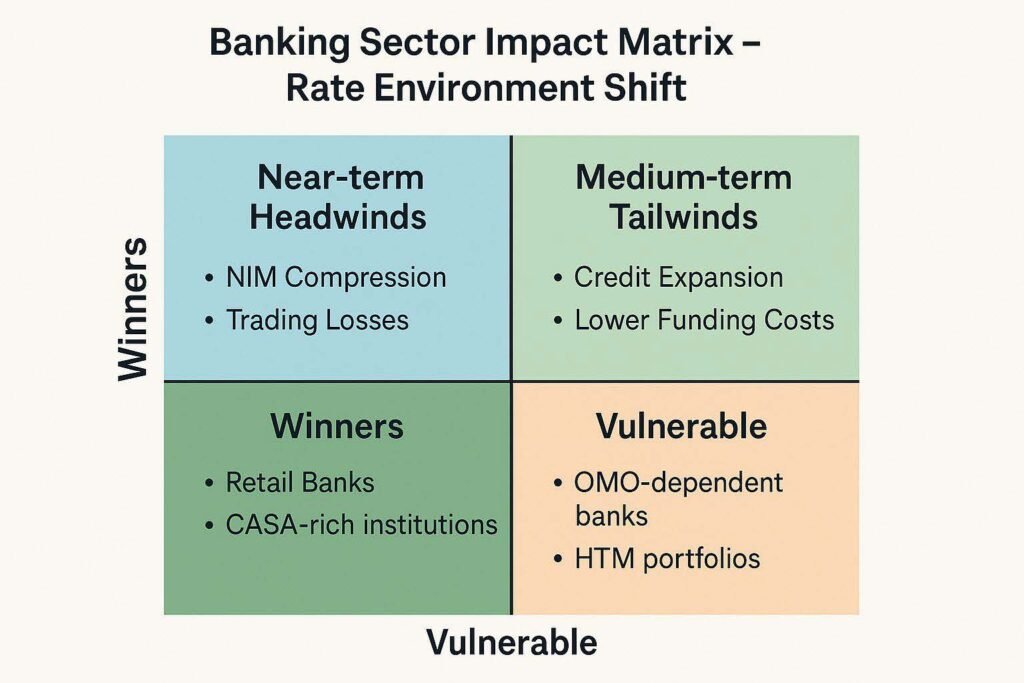

The implications of these developments extend well beyond the immediate money markets. The banking sector faces a complex transition period characterized by near-term margin compression offset by medium-term opportunities for credit expansion. Net interest margins are expected to face immediate pressure as high-yielding government securities reprice lower, while trading book losses from mark-to-market adjustments on existing holdings may impact third-quarter earnings.

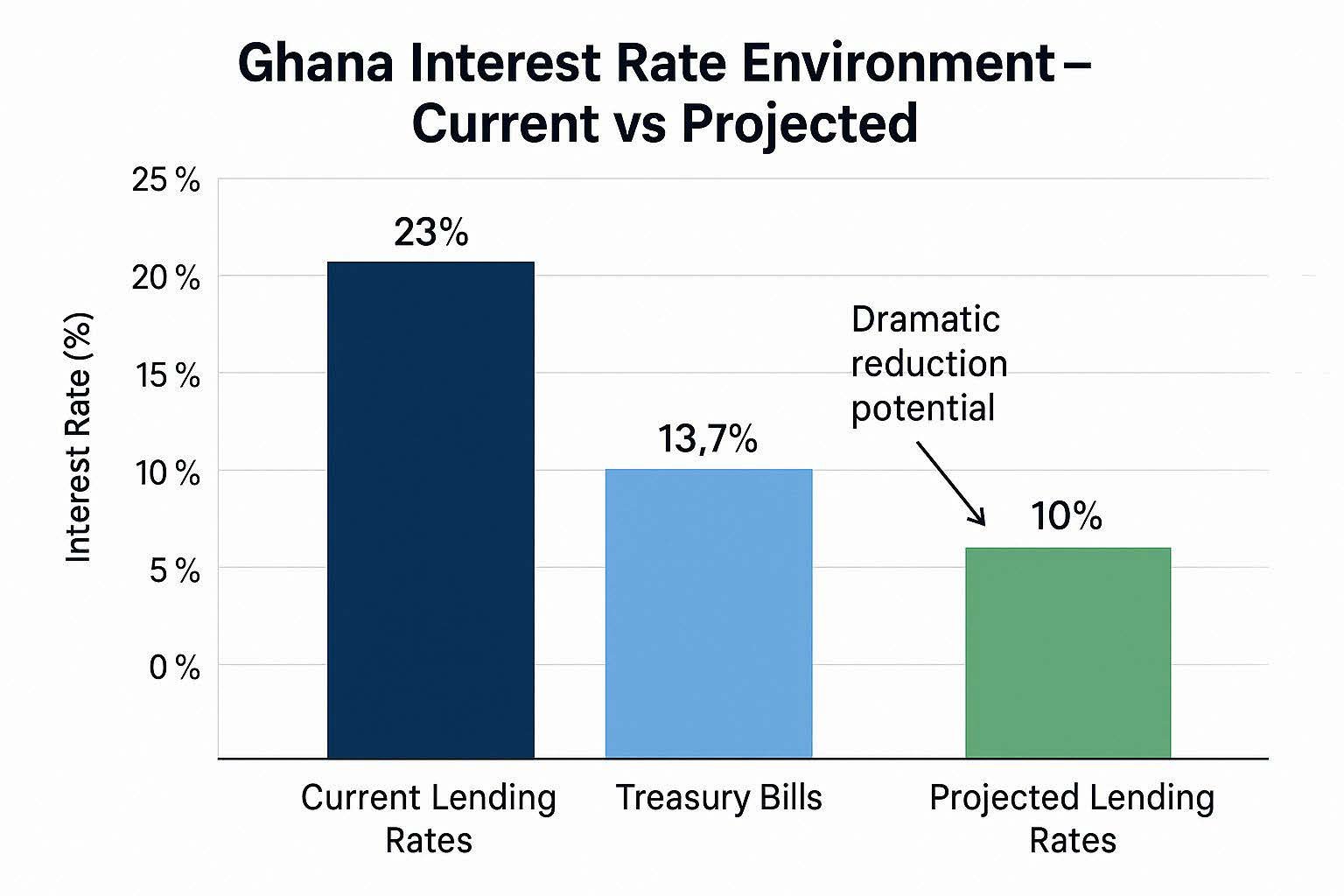

However, the anticipated reduction in the Ghana Reference Rate (GRR) from current levels of 23% toward a target of approximately 10% presents unprecedented opportunities for credit growth. This dramatic reduction in lending rates is expected to stimulate loan demand across retail, small and medium enterprise (SME), and corporate segments, potentially generating 15-20% year-over-year loan growth by 2026.

For consumers, this monetary transformation promises the dawn of affordable credit access. Mortgage and auto loan rates, currently ranging from 25-30%, could decline to 12-15% by 2026, while SME working capital costs may fall below 20% for the first time in recent memory. This credit accessibility improvement, combined with declining inflation, is expected to boost household purchasing power and stimulate domestic economic activity.

The foreign exchange market presents a more nuanced picture, with USD/GHS spot rates remaining relatively stable despite underlying supply-demand imbalances. Surging foreign currency demand, unmet by corresponding supply increases, has created execution delays in the FX market. The BoG’s intervention is anticipated to address these liquidity gaps and maintain market functionality.

Looking ahead, the Monetary Policy Committee (MPC) meeting scheduled for next week is expected to formalize this regime change with a policy rate reduction of 100-150 basis points. This decision would signal the central bank’s commitment to supporting economic growth while capitalizing on the improved inflation outlook.

The convergence of these factors positions Ghana’s economy for potential GDP acceleration of 1-2 percentage points by 2026, driven by increased credit availability, lower debt service burdens, and enhanced business investment capacity. However, success hinges on prudent risk management, particularly in credit underwriting standards and foreign exchange market stability.

This comprehensive analysis examines each of these dimensions in detail, providing stakeholders with the insights necessary to navigate this transformative period in Ghana’s capital markets evolution.

Market Developments & Key Drivers

Liquidity Transformation and Central Bank Operations

The current market environment has been fundamentally shaped by the Bank of Ghana’s strategic operational adjustments, which have created unprecedented liquidity conditions in the domestic money markets. The central bank’s decision to suspend overnight borrowing facilities represents a deliberate policy choice to increase system-wide liquidity and facilitate the transmission of monetary policy through lower interest rates.

This suspension has effectively removed a key liquidity absorption mechanism from the market, forcing banks to deploy excess funds through alternative channels. The immediate consequence has been a flood of Ghana cedi liquidity into the interbank market, creating competitive pressure among financial institutions to deploy these funds productively. Banks, faced with excess cash positions and limited overnight placement options, have been compelled to bid aggressively for available investment opportunities, particularly government securities.

The scale-back of Open Market Operations has amplified these liquidity effects. The BoG’s significant reduction in OMO issuance has created a supply-demand imbalance in the short-term government securities market. With fewer OMO instruments available for purchase, banks have concentrated their bidding on the reduced supply, driving yields dramatically lower. This mechanism has proven to be an effective tool for accelerating monetary policy transmission, as the impact on short-term rates has been both immediate and substantial.

Interest Rate Dynamics and Market Response

The interest rate environment has experienced unprecedented volatility and compression over the past fortnight. The OMO rate trajectory tells a compelling story of market adjustment: from 28% in early July to 17.5% in mid-July, culminating in the dramatic decline to 12.51% on July 23rd. This 55% reduction in yields within a two-week period represents one of the most rapid interest rate adjustments in Ghana’s recent monetary history.

The velocity of this rate compression reflects several underlying factors. First, the abundance of Ghana cedi liquidity has reduced funding pressures across the banking system, enabling institutions to accept lower returns on government securities. Second, the reduced supply of OMO instruments has concentrated demand, creating competitive bidding conditions that have driven yields progressively lower. Third, market participants have begun to anticipate further monetary policy easing, leading to forward-looking positioning that has accelerated the rate decline.

The transmission of these OMO rate changes to broader money market conditions has been remarkably efficient. Treasury bill yields have aligned closely with OMO rates, falling to approximately 13.7%, while government bond yields have compressed to around 16.5%. This alignment demonstrates the effectiveness of the BoG’s operational approach in achieving broad-based interest rate reduction across the yield curve.

Inflation Dynamics and Economic Context

The improvement in Ghana’s inflation trajectory has provided crucial support for the current monetary policy stance. The decline from 18.8% in May to 13.7% in June 2025 represents a significant disinflation trend that has created space for accommodative monetary policy. This inflation reduction reflects several factors, including base effects from previous high inflation periods, improved supply chain conditions, and relative exchange rate stability.

The disinflation trend has been particularly important in validating the BoG’s decision to pursue aggressive liquidity injection and rate reduction. With inflation pressures moderating, the central bank has been able to prioritize growth objectives without compromising price stability mandates. This policy space has enabled the dramatic operational adjustments that have driven the current market transformation.

The inflation outlook remains supportive of continued monetary accommodation. Leading indicators suggest that the disinflation trend may continue, providing additional justification for the anticipated MPC rate reduction. However, monitoring of inflation expectations and core inflation measures will be critical to ensure that the aggressive monetary stance does not reignite price pressures.

Market Structure and Participant Behavior

The current market environment has revealed important insights about the structure and behavior of Ghana’s financial markets. The rapid transmission of BoG operational changes to market rates demonstrates the effectiveness of the central bank’s policy tools and the responsiveness of market participants to liquidity conditions.

Banking sector behavior has been particularly notable during this period. The aggressive bidding for OMO instruments and the rapid adjustment of lending rate expectations suggest that financial institutions are well-positioned to transmit monetary policy changes to the broader economy. This responsiveness bodes well for the effectiveness of the anticipated policy rate reduction in stimulating credit growth and economic activity.

The concentration of market activity in government securities markets has also highlighted the importance of these instruments in Ghana’s financial system. The ability of OMO and Treasury bill markets to absorb and transmit liquidity changes effectively demonstrates the maturity and functionality of these market segments.

| Key Market Indicators | Early July | Mid-July | July 23 | Change |

|---|---|---|---|---|

| OMO Rates | 28.0% | 17.5% | 12.51% | -55% |

| Treasury Bills | ~20% | ~16% | 13.7% | -32% |

| Government Bonds | ~22% | ~19% | 16.5% | -25% |

| Inflation (YoY) | 18.8% (May) | – | 13.7% (June) | -27% |

| Interbank Liquidity | Tight | Moderate | Abundant | Structural Shift |

Interest Rate Environment Analysis

The transformation of Ghana’s interest rate environment represents one of the most dramatic monetary policy transmissions in the country’s recent financial history. The Open Market Operations rate trajectory, as illustrated in the chart above, demonstrates the unprecedented velocity of change that has characterized the current monetary cycle.

Short-Term Rate Dynamics

The collapse in OMO rates from 28% to 12.51% within a two-week period reflects the powerful interaction between central bank policy tools and market liquidity conditions. This 55% reduction in yields has occurred through a combination of supply constraint and demand concentration. The Bank of Ghana’s decision to significantly reduce OMO issuance created a scarcity of short-term government securities, while simultaneously flooding the market with excess Ghana cedi liquidity through the suspension of overnight borrowing facilities.

The mechanics of this rate compression reveal important insights about the structure and efficiency of Ghana’s money markets. The rapid transmission of liquidity conditions to interest rate outcomes demonstrates that the financial system’s plumbing is functioning effectively, with banks able to quickly adjust their bidding behavior in response to changing supply-demand dynamics. This responsiveness suggests that further monetary policy adjustments will likely transmit efficiently to broader economic conditions.

Inflation Context and Policy Space

The concurrent improvement in Ghana’s inflation trajectory has provided crucial validation for the aggressive monetary accommodation. The 27% decline in year-over-year inflation from 18.8% in May to 13.7% in June 2025 has created significant policy space for the Bank of Ghana to pursue growth-supportive measures without compromising price stability objectives.

This disinflation trend reflects several underlying factors that support the sustainability of lower interest rates. Base effects from the previous year’s high inflation readings have contributed to the mathematical decline in year-over-year comparisons. Additionally, improved supply chain conditions, relative exchange rate stability, and moderating global commodity price pressures have all contributed to the more favorable inflation environment.

The inflation outlook remains supportive of continued monetary accommodation. Leading indicators, including producer price trends, import price developments, and inflation expectations surveys, suggest that the disinflation momentum may continue through the remainder of 2025. This trajectory provides the Bank of Ghana with continued flexibility to maintain accommodative monetary conditions while supporting economic growth objectives.

Yield Curve Implications

The dramatic compression in short-term rates has significant implications for the broader yield curve structure. The current environment, with Treasury bills yielding 13.7% and the anticipated reduction in lending rates from 23% to approximately 10%, suggests a fundamental repricing of risk and term premiums across the interest rate spectrum.

The flattening of the yield curve, with short-term rates declining more rapidly than long-term rates, reflects several factors. First, the immediate impact of excess liquidity is most pronounced in the short-term money markets where banks deploy surplus funds. Second, long-term rates incorporate expectations about future monetary policy, inflation, and fiscal conditions, which may adjust more gradually than spot rates.

This yield curve evolution has important implications for different market participants. Banks with asset-liability mismatches may face margin pressure as funding costs adjust more slowly than asset yields. Conversely, institutions with flexible balance sheet structures may benefit from the opportunity to lock in higher long-term rates while funding at lower short-term costs.

International Context and Competitiveness

Ghana’s interest rate transformation must be evaluated within the broader context of regional and global monetary conditions. The dramatic reduction in domestic rates improves the country’s competitiveness for domestic investment while potentially affecting capital flow dynamics. Lower domestic rates reduce the cost of capital for local businesses, potentially stimulating investment and economic activity.

However, the interest rate differential with international markets remains a consideration for foreign exchange stability. The Bank of Ghana’s approach of combining domestic rate reduction with foreign exchange market intervention suggests a recognition of these trade-offs and a commitment to maintaining overall financial stability while pursuing growth objectives.

The regional context also supports Ghana’s monetary accommodation. With several West African economies experiencing similar disinflation trends and pursuing accommodative monetary policies, Ghana’s approach aligns with broader regional monetary conditions, reducing the risk of destabilizing capital flow reversals.

Banking Sector Performance Outlook

The transformation of Ghana’s interest rate environment presents the banking sector with a complex landscape of challenges and opportunities that will unfold across different time horizons. The banking impact matrix above illustrates the multifaceted nature of these effects, highlighting the need for strategic positioning and operational agility during this transition period.

Near-Term Headwinds and Margin Pressure

The immediate impact of the dramatic OMO rate collapse on banking sector profitability cannot be understated. Financial institutions face unprecedented net interest margin (NIM) compression as their high-yielding government securities portfolios reprice to current market levels. Banks with significant exposure to OMO instruments and Treasury bills will experience immediate revenue erosion as these assets mature and are reinvested at substantially lower rates.

The magnitude of this margin pressure is particularly acute for institutions that have built business models around high-yielding government paper. Banks with OMO income representing more than 20% of total revenues face the most significant near-term challenges. These institutions must rapidly adapt their asset allocation strategies and pricing models to maintain profitability in the new rate environment.

Trading book losses represent another immediate headwind for the banking sector. Mark-to-market adjustments on existing high-yield government securities holdings will likely impact third-quarter earnings across the sector. Banks with large held-to-maturity (HTM) portfolios may face particular challenges as they lack the flexibility to realize gains from the rate rally while still experiencing economic losses on their fixed-rate assets.

The foreign exchange liquidity strains add another layer of complexity to the near-term outlook. Banks’ inability to efficiently meet corporate USD demand may disrupt established transaction banking relationships and reduce fee income from foreign exchange services. This operational challenge requires immediate attention to maintain client relationships and preserve revenue streams.

Medium-Term Tailwinds and Growth Opportunities

Despite the near-term challenges, the medium-term outlook for Ghana’s banking sector is considerably more positive. The anticipated reduction in the Ghana Reference Rate from 23% to approximately 10% represents a transformational opportunity for credit expansion and volume-driven growth.

The credit expansion catalyst is particularly significant for banks with strong retail distribution networks and efficient loan origination capabilities. As borrowing costs decline dramatically, pent-up demand for credit across retail, SME, and corporate segments is expected to materialize rapidly. Banks positioned to capture this demand through digital channels, streamlined approval processes, and competitive pricing will benefit from substantial volume growth that can offset margin compression.

Lower funding costs represent another significant medium-term tailwind. The excess Ghana cedi liquidity in the system reduces interbank borrowing costs and alleviates pressure on deposit rates. Banks with strong current account and savings account (CASA) ratios will benefit most from this structural shift, as their funding cost advantages become more pronounced in the new environment.

Fee income opportunities are expected to expand significantly as credit activity increases. Loan processing fees, advisory services, and transaction-related income should grow substantially as businesses and consumers increase their borrowing activity. Banks with comprehensive service offerings and strong client relationships are well-positioned to capitalize on these opportunities.

Strategic Positioning and Competitive Dynamics

The current environment is creating clear winners and losers within Ghana’s banking sector based on strategic positioning and operational capabilities. Retail-focused banks with agile pricing models and strong digital capabilities are emerging as the primary beneficiaries of the new rate environment.

Institutions with low-cost deposit bases, particularly those with high CASA ratios, possess significant competitive advantages in the current environment. These banks can maintain profitability even as interest margins compress, while their higher-cost competitors face more severe pressure. The ability to mobilize low-cost deposits becomes a critical differentiator in the new competitive landscape.

Digital banking capabilities are proving increasingly important as banks seek to capture the anticipated surge in credit demand. Institutions with streamlined digital onboarding processes, automated credit decisioning, and mobile banking platforms are better positioned to scale their lending operations efficiently and cost-effectively.

Conversely, banks with structural vulnerabilities face significant challenges in adapting to the new environment. Institutions heavily reliant on OMO income, those with large HTM portfolios locked at higher rates, and banks with high operational costs relative to their asset bases are most vulnerable to the current transition.

Risk Management and Asset Quality Considerations

The rapid expansion of credit availability raises important questions about risk management and asset quality maintenance. As banks compete aggressively for loan growth in the new environment, maintaining prudent underwriting standards becomes critical to long-term sustainability.

The historical relationship between rapid credit expansion and subsequent asset quality deterioration requires careful monitoring. Banks must balance the opportunity for volume growth with the need to maintain sound credit risk management practices. Institutions with robust risk management frameworks and experienced credit teams are better positioned to navigate this balance successfully.

Regulatory oversight and capital adequacy considerations also become more important as banks expand their lending activities. The Bank of Ghana’s supervisory approach during this transition period will be crucial in ensuring that the benefits of increased credit availability are not undermined by deteriorating asset quality or excessive risk-taking.

Performance Metrics and Timeline Expectations

| Performance Factor | Impact Magnitude | Timeline | Key Beneficiaries |

|---|---|---|---|

| NIM Compression | 3-5% QoQ pressure | Immediate | None (universal headwind) |

| Trading Income | Significant decline | Q3 2025 | AFS portfolio holders |

| Loan Growth | 15-20% YoY potential | Q4 2025-2026 | Retail-focused banks |

| Fee Income | 10-15% increase | 2026 | Digital-enabled banks |

| Funding Costs | 2-3% reduction | Ongoing | CASA-rich institutions |

| Credit Costs | Monitor closely | 2026-2027 | Strong risk management |

The timeline for these various impacts suggests that the banking sector’s performance will follow a J-curve pattern, with near-term pressure giving way to medium-term outperformance for well-positioned institutions. Banks that can successfully navigate the transition period while positioning for credit growth are likely to emerge as the sector’s long-term winners.

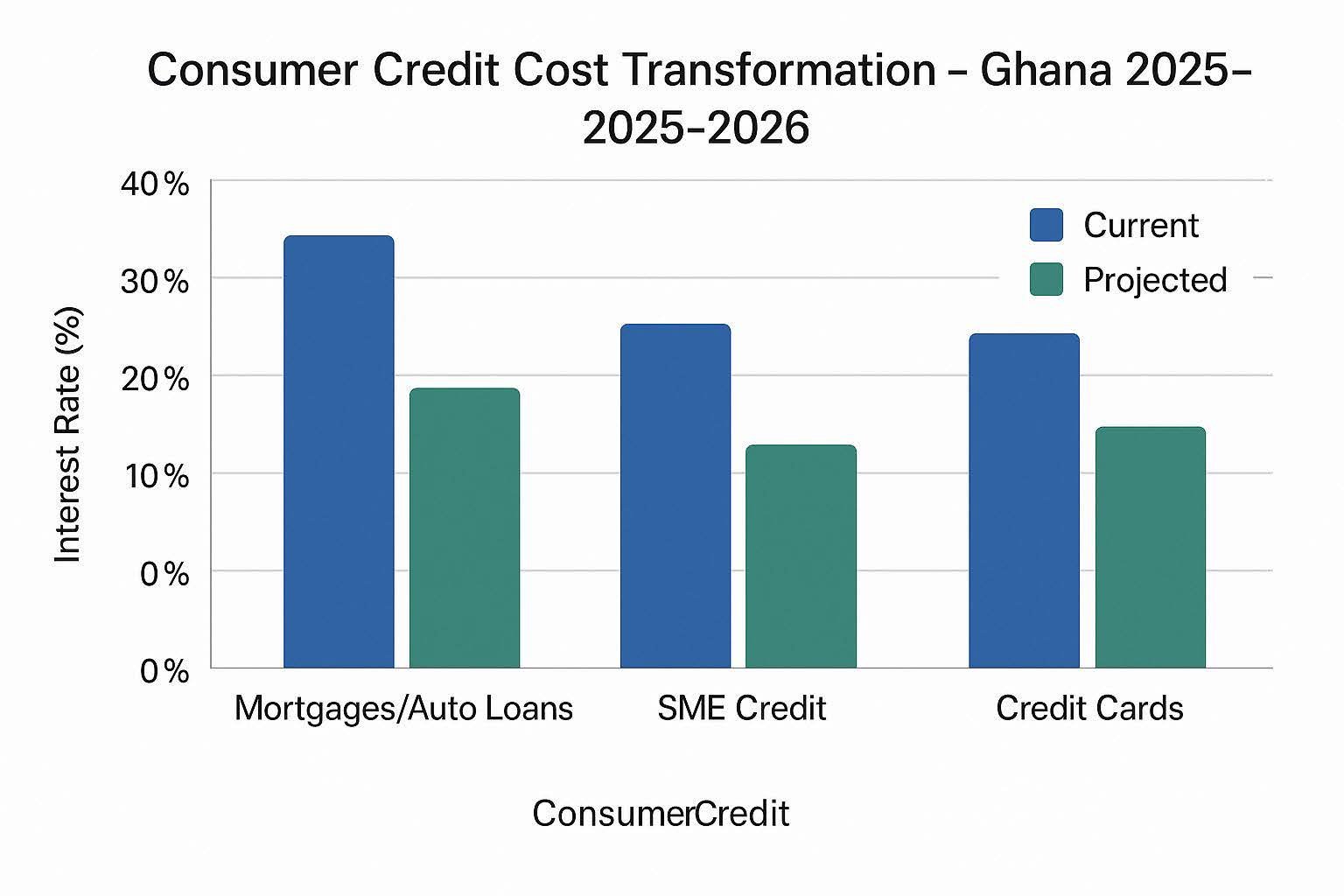

Consumer Impact & Credit Accessibility

The transformation of Ghana’s interest rate environment promises to deliver unprecedented benefits to consumers and small businesses through dramatically improved credit accessibility and affordability. The consumer credit cost comparison chart above illustrates the magnitude of the potential savings across different lending categories, representing one of the most significant improvements in financial inclusion in Ghana’s recent history.

The Dawn of Affordable Credit

The anticipated reduction in lending rates represents a paradigm shift for Ghanaian consumers who have long faced prohibitively high borrowing costs. Mortgage and auto loan rates, currently ranging from 25-30%, are projected to decline to 12-15% by 2026, effectively halving the cost of homeownership and vehicle financing for middle-class consumers.

This dramatic reduction in mortgage rates has profound implications for Ghana’s housing market and homeownership rates. A typical 20-year mortgage of GHS 200,000 would see monthly payments decline from approximately GHS 4,400 at 28% to GHS 2,200 at 14%, representing a 50% reduction in debt service burden. This improvement makes homeownership accessible to a significantly broader segment of the population, potentially stimulating construction activity and related economic sectors.

Small and medium enterprise (SME) credit represents another area of transformational change. Working capital loans, currently priced around 25%, are expected to fall below 20% and potentially reach 15% for creditworthy borrowers. This reduction is particularly significant for Ghana’s SME sector, which has historically been constrained by high financing costs that made business expansion and inventory financing economically challenging.

The impact on credit card and consumer loan rates, while still elevated, represents meaningful improvement for household finances. Current rates exceeding 35% are expected to decline to approximately 25%, providing relief for consumers managing short-term financing needs and emergency expenses.

Purchasing Power Enhancement

The combination of declining inflation and reduced debt service burdens creates a powerful boost to household purchasing power. Real income growth accelerates as both nominal income growth exceeds inflation and existing debt obligations consume a smaller share of household budgets.

For households with existing variable-rate debt, the immediate benefit of rate reductions provides direct cash flow relief. A typical household with GHS 50,000 in outstanding loans at 25% would see annual interest payments decline by GHS 6,500 if rates fall to 12%, representing a meaningful increase in disposable income.

The wealth effect from improved credit accessibility extends beyond direct borrowers to the broader economy. Increased homeownership rates, higher business investment levels, and enhanced consumer spending capacity create positive multiplier effects that benefit even those who do not directly access credit markets.

Behavioral Shifts and Financial Inclusion

The dramatic improvement in credit affordability is expected to drive significant behavioral changes in how Ghanaians approach financial planning and investment. Previously uneconomical investments in education, business expansion, and durable goods become viable at lower interest rates, potentially accelerating human capital development and productivity growth.

Financial inclusion metrics are likely to improve substantially as formal credit becomes accessible to previously excluded populations. Small business owners who relied on informal lending at extremely high rates can now access bank credit at competitive terms, potentially formalizing economic activity and improving tax collection.

The shift toward formal financial services has important implications for monetary policy transmission. As more economic activity occurs through the formal banking system, the Bank of Ghana’s policy tools become more effective in influencing broader economic conditions.

Risk Considerations and Behavioral Challenges

While the benefits of improved credit accessibility are substantial, the rapid transition to a low-rate environment also presents risks that require careful monitoring. The potential for a credit bubble emerges if risk assessment standards weaken amid aggressive competition for loan growth.

Consumer behavior adaptation to the new rate environment may take time, with some households potentially over-leveraging in response to improved affordability. Financial literacy and responsible lending practices become increasingly important as credit access expands rapidly.

The savings rate implications of lower interest rates also require consideration. Fixed-income investors, including pension funds and conservative savers, may see reduced returns on their investments, potentially necessitating adjustments to retirement planning and investment strategies.

Import Cost Considerations and Exchange Rate Effects

The persistent USD scarcity in Ghana’s foreign exchange markets presents a potential offset to the domestic benefits of lower interest rates. Import-dependent consumers may face higher costs for foreign goods even as domestic financing becomes more affordable.

The interaction between domestic monetary accommodation and foreign exchange market conditions requires careful balance. While lower domestic rates support economic growth, they may also increase demand for foreign currency as investment and consumption patterns shift.

Sector-Specific Impacts

Different consumer segments and economic sectors will experience varying degrees of benefit from the improved credit environment. The housing sector stands to benefit most dramatically, with potential for significant increases in construction activity and related employment.

The automotive sector, both new and used vehicle markets, should experience substantial growth as financing becomes more accessible. This has implications for import demand, dealer networks, and related service industries.

Small business development across sectors from retail to manufacturing should accelerate as working capital becomes more affordable. This is particularly important for Ghana’s economic diversification objectives and job creation goals.

Timeline and Implementation Considerations

The transmission of lower policy rates to consumer lending rates will occur gradually, with different lenders adjusting their pricing at different speeds. Competitive pressures and regulatory guidance will influence the pace of this transmission.

Early adopters among both lenders and borrowers will capture the greatest benefits from the rate environment shift. Consumers who refinance existing high-rate debt quickly will realize immediate savings, while those who delay may miss opportunities for optimal timing.

The full economic impact of improved credit accessibility will likely unfold over 18-24 months as behavioral changes take effect and investment projects initiated with cheaper financing begin to generate economic returns.

| Consumer Segment | Current Challenge | Expected Benefit | Timeline |

|---|---|---|---|

| First-time homebuyers | 28% mortgage rates | 14% rates, 50% payment reduction | 2026 |

| SME owners | 25% working capital costs | <20% rates, improved cash flow | Q4 2025 |

| Credit card users | 35%+ consumer rates | 25% rates, reduced debt burden | 2025-2026 |

| Auto buyers | 30% financing costs | 15% rates, expanded access | 2026 |

| Students/Education | Limited loan access | New education financing products | 2026-2027 |

Foreign Exchange Market Dynamics

While Ghana’s domestic currency markets have experienced dramatic transformation, the foreign exchange market presents a more complex and nuanced picture that requires careful analysis and policy attention. The market liquidity flow diagram above illustrates how domestic monetary accommodation has created both opportunities and challenges in the FX market.

USD Liquidity Constraints and Market Functionality

Despite the relative stability of USD/GHS spot rates, underlying supply-demand imbalances have created significant operational challenges in Ghana’s foreign exchange market. The surge in foreign currency demand, driven by increased economic activity and import requirements, has not been matched by corresponding increases in USD supply, resulting in execution delays and market friction.

Corporate clients seeking to execute large USD transactions have experienced extended settlement periods, disrupting normal business operations and creating uncertainty in trade finance arrangements. This disconnect between stable spot rates and operational difficulties suggests that the foreign exchange market is experiencing stress beneath the surface stability.

The sources of USD demand have diversified as economic activity has increased. Import financing requirements have grown as domestic demand strengthens, while corporate investment projects funded by cheaper domestic credit often require foreign currency components. Additionally, portfolio rebalancing by institutional investors seeking to diversify away from lower-yielding domestic assets has contributed to FX demand pressure.

Central Bank Intervention Dynamics

The Bank of Ghana’s approach to foreign exchange market management during this period of domestic monetary accommodation demonstrates sophisticated understanding of the trade-offs involved in maintaining both domestic growth objectives and external stability. The central bank’s anticipated intervention to address USD liquidity gaps reflects a commitment to market functionality rather than exchange rate targeting.

The timing and scale of BoG intervention will be crucial in maintaining market confidence while preserving the benefits of domestic monetary accommodation. Excessive intervention could undermine the domestic liquidity conditions that have driven the beneficial rate environment, while insufficient action could allow FX market dysfunction to spread to other areas of the financial system.

The central bank’s foreign exchange reserves position and access to external financing facilities provide important buffers for managing this transition period. However, the sustainability of intervention depends on addressing underlying supply-demand imbalances rather than simply providing temporary liquidity relief.

Trade Finance and Corporate Banking Implications

The foreign exchange market challenges have particular significance for trade finance and corporate banking operations. Banks’ ability to provide timely and efficient FX services to corporate clients affects their competitive positioning and fee income generation.

Corporate treasurers have been forced to adjust their foreign exchange risk management strategies, potentially increasing hedging costs and operational complexity. Companies with significant import requirements or foreign currency obligations face increased uncertainty in cash flow planning and working capital management.

The trade finance sector, which relies heavily on efficient FX market functioning, has experienced particular strain. Letters of credit, trade guarantees, and other trade finance instruments require reliable foreign exchange execution to maintain their effectiveness as risk management tools.

Regional and International Context

Ghana’s foreign exchange market challenges must be understood within the broader context of regional and global currency dynamics. Several West African economies are experiencing similar pressures as domestic monetary accommodation creates demand for foreign currency while global supply conditions remain constrained.

The international environment, characterized by elevated USD strength and reduced emerging market capital flows, compounds the challenges facing Ghana’s FX market. Global risk sentiment and commodity price developments continue to influence the availability and cost of foreign currency for emerging market economies.

Regional integration initiatives and currency cooperation mechanisms may provide some relief for intra-African trade, but the majority of Ghana’s foreign exchange requirements relate to global trade and investment flows that require USD or other major currencies.

Monetary Policy Outlook

Expected MPC Decision and Rationale

Market consensus strongly favors a policy rate reduction of 100-150 basis points, which would formalize the dramatic shift in monetary conditions that has already occurred through the Bank of Ghana’s operational adjustments. This anticipated cut reflects the central bank’s confidence in the improved inflation trajectory and its commitment to supporting economic growth through lower borrowing costs.

The rationale for aggressive rate reduction is compelling across multiple dimensions. The 27% decline in year-over-year inflation from 18.8% to 13.7% provides clear justification for accommodative policy, while the successful transmission of liquidity conditions to market rates demonstrates the effectiveness of the central bank’s operational approach.

Economic growth considerations also support aggressive monetary accommodation. Ghana’s economy has shown resilience but requires additional stimulus to achieve its full potential. Lower borrowing costs can unlock investment projects that were previously uneconomical, supporting job creation and productivity growth.

Policy Transmission Mechanisms

The effectiveness of monetary policy transmission in the current environment has been demonstrated through the rapid adjustment of market rates to liquidity conditions. This efficiency suggests that further policy rate reductions will quickly translate into broader economic benefits.

The Ghana Reference Rate mechanism provides a direct link between central bank policy decisions and commercial lending rates, ensuring that policy accommodation reaches end borrowers efficiently. The anticipated alignment of the GRR with lower policy rates will complete the transmission process and maximize the economic impact of monetary accommodation.

Credit channel transmission is expected to be particularly effective given the excess liquidity in the banking system and the competitive pressure for loan growth. Banks’ eagerness to deploy surplus funds should ensure rapid transmission of lower policy rates to lending conditions.

Forward Guidance and Communication Strategy

The Bank of Ghana’s communication strategy around the anticipated policy rate cut will be crucial in managing market expectations and maintaining confidence in the central bank’s commitment to price stability. Clear forward guidance about the conditions that would trigger further accommodation or policy reversal will help anchor expectations.

The central bank’s emphasis on data-dependent policy making provides flexibility while maintaining credibility. Continued focus on inflation developments, economic growth indicators, and financial stability metrics will guide future policy decisions.

International communication and coordination with multilateral institutions will also be important in maintaining external confidence in Ghana’s monetary policy framework and supporting continued access to international financing.

Strategic Recommendations

For Banking Institutions

- Banks should prioritize rapid repricing of loan portfolios to capture market share in the expanding credit market. Institutions that move quickly to offer competitive rates while maintaining sound underwriting standards will benefit most from the anticipated credit boom.

- Balance sheet optimization becomes critical in the new rate environment. Banks should consider shifting from hold-to-maturity to available-for-sale classifications for government securities to maintain flexibility in managing interest rate risk.

- Current account and savings account (CASA) mobilization should be a strategic priority, as low-cost deposits become an increasingly important competitive advantage. Digital banking capabilities and customer service excellence will be key differentiators in deposit mobilization efforts.

- Credit risk management frameworks require strengthening to handle the anticipated surge in lending activity. Banks should invest in automated credit decisioning systems, enhanced monitoring capabilities, and experienced credit personnel to maintain asset quality during rapid growth.

For Corporate Borrowers

- Companies should advance capital expenditure plans to take advantage of the dramatically lower borrowing costs. Projects that were previously uneconomical at 23% lending rates become highly attractive at projected rates of 10-12%.

- Foreign exchange risk management becomes increasingly important as domestic monetary accommodation may affect currency dynamics. Companies with significant foreign currency exposures should consider hedging strategies and natural hedging through operational adjustments.

- Working capital optimization opportunities abound as financing costs decline. Companies should review their cash management strategies and consider increasing inventory levels or extending payment terms to customers where economically beneficial.

- Strategic planning horizons should be extended to capitalize on the improved financing environment. Multi-year investment projects become more viable, supporting long-term competitive positioning and market expansion.

For Individual Consumers

- Debt refinancing should be a priority for consumers with existing high-rate obligations. Credit card debt, personal loans, and other high-cost borrowing should be refinanced as soon as competitive rates become available.

- Homeownership planning becomes more viable for middle-class consumers as mortgage rates decline. Potential homebuyers should begin preparing for mortgage applications and consider locking in favorable rates when available.

- Investment strategy adjustments may be necessary as fixed-income returns decline. Consumers should consider diversifying into equity investments, real estate, or other assets that may benefit from the improved economic environment.

- Financial planning timelines should be updated to reflect the new interest rate environment. Retirement planning, education funding, and other long-term financial goals may require strategy adjustments.

Risk Assessment & Monitoring Points

Credit Quality and Asset Bubbles

The rapid expansion of credit availability raises legitimate concerns about potential asset quality deterioration and bubble formation. Historical precedents suggest that periods of dramatic rate reduction can lead to excessive risk-taking and subsequent financial instability.

Monitoring indicators should include loan growth rates by sector, credit standards evolution, and early warning signals of speculative activity. Real estate markets, in particular, require careful observation as mortgage rate reductions could drive unsustainable price increases.

Regulatory oversight and macroprudential tools may be necessary to prevent excessive risk accumulation. The Bank of Ghana should maintain readiness to implement countercyclical measures if credit growth becomes excessive or concentrated in particular sectors.

Foreign Exchange Stability

The sustainability of the current foreign exchange market approach depends on addressing underlying supply-demand imbalances rather than relying solely on central bank intervention. Continued monitoring of reserve levels, current account dynamics, and capital flow patterns is essential.

External financing requirements and debt service obligations must be carefully managed to avoid foreign exchange crises. The government’s fiscal position and external borrowing strategy will significantly influence FX market stability.

Regional and global developments, including commodity price movements and international capital flow patterns, require continuous assessment as they directly impact Ghana’s foreign exchange market conditions.

Fiscal Policy Coordination

The success of monetary accommodation depends partly on supportive fiscal policy that avoids crowding out private sector credit demand. Government borrowing requirements and debt management strategies should be coordinated with monetary policy objectives.

Fiscal sustainability metrics require ongoing monitoring to ensure that monetary accommodation is not undermined by excessive government borrowing or unsustainable debt dynamics. The debt-to-GDP ratio and fiscal deficit trends are key indicators.

Revenue mobilization efforts should be enhanced to reduce government dependence on domestic borrowing, creating more space for private sector credit expansion and maintaining the benefits of lower interest rates.

Inflation Expectations and Price Stability

While current inflation trends support monetary accommodation, vigilant monitoring of inflation expectations and core price pressures is essential to prevent policy mistakes. Leading indicators of price pressure should be tracked closely.

Supply-side inflation risks, including food price volatility and energy costs, require particular attention as they could necessitate policy adjustments even in a generally accommodative environment.

International price developments and exchange rate pass-through effects must be monitored to ensure that domestic monetary accommodation does not inadvertently contribute to imported inflation pressures.

Conclusion & Forward View

Ghana’s capital markets are experiencing a historic transformation that promises to reshape the country’s economic landscape for years to come. The confluence of aggressive monetary accommodation, improved inflation dynamics, and structural liquidity changes has created conditions for sustained economic growth and enhanced financial inclusion.

The dramatic 55% collapse in OMO rates within a two-week period represents more than a technical market adjustment; it signals a fundamental shift in Ghana’s monetary regime toward growth support and credit accessibility. This transformation, validated by the 27% decline in inflation and supported by excess domestic liquidity, positions Ghana for its strongest pro-growth monetary pivot since 2020.

The banking sector faces a complex transition characterized by near-term margin pressure offset by unprecedented opportunities for credit expansion. Institutions that successfully navigate this transition through strategic positioning, operational excellence, and prudent risk management will emerge as long-term winners in a transformed competitive landscape.

For consumers and businesses, the promise of affordable credit represents a generational opportunity. Mortgage rates declining from 28% to 14%, SME financing costs falling below 20%, and the general improvement in credit accessibility will unlock economic potential that has been constrained by high financing costs for years.

The anticipated MPC decision next week will formalize this regime change and provide the policy foundation for sustained accommodation. A 100-150 basis point rate cut, combined with continued operational support for liquidity conditions, will complete the transmission mechanism and maximize the economic benefits of the current approach.

However, success is not guaranteed and depends on careful management of emerging risks. Foreign exchange market stability, credit quality maintenance, and fiscal policy coordination all require ongoing attention to ensure that the benefits of monetary accommodation are sustained and broadly shared.

The forward view suggests potential GDP acceleration of 1-2 percentage points by 2026, driven by increased investment, enhanced consumer spending, and improved business confidence. This economic dividend, if realized, would validate the bold monetary policy approach and establish Ghana as a regional leader in pro-growth economic management.

The transformation currently underway in Ghana’s capital markets represents more than a cyclical adjustment; it constitutes a structural shift toward a more dynamic, inclusive, and growth-oriented financial system. The successful navigation of this transition will determine Ghana’s economic trajectory for the remainder of the decade and beyond.

As stakeholders across the economy adapt to this new environment, the emphasis must remain on sustainable growth, prudent risk management, and inclusive development that ensures the benefits of improved financial conditions reach all segments of Ghanaian society. The opportunity is historic; the execution will be decisive.

This analysis is based on market conditions as of July 24, 2025, and reflects the author’s professional assessment of current developments and future prospects. Forward-looking statements are subject to change based on evolving economic conditions and policy decisions.